| 02-15-2024, 11:06 AM | #8163 | |

|

Major General

10161

Rep 8,626

Posts |

Quote:

if volume, then this is bad if dollars, then this is REALLY bad considering price increases

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

|

Appreciate

0

|

| 02-15-2024, 02:46 PM | #8164 | |

|

Major General

5554

Rep 5,372

Posts |

Quote:

My wife and I want to downsize from our late 1970s 1,900 ft2 home to a 1,000-1,200 ft2 home on some rural land and we cannot find a single reputable builder that wants to have anything to do with building anything but a big ass house and we've been looking since 2019. I think the lack of builders (and governments) willing to build smaller homes is a HUGE problem. The majority of couples/families do not need a 5 bedroom, 5 bath, 3 car garage, 3K+ ft2 home. I had lots of friends growing up that lived in 3-4 bedrooms 1,000-1,700 ft2 homes. No one builds that now in most areas of the country.

__________________

The forest was shrinking, but the Trees kept voting for the Axe, for the Axe was clever and convinced the Trees that because his handle was made of wood, he was one of them.

|

|

|

Appreciate

2

vreihen1615277.00 Car-Addicted7049.00 |

| 02-15-2024, 02:51 PM | #8165 | |

|

Major General

5554

Rep 5,372

Posts |

Quote:

When a company blames rises costs and subsequently raises prices over and over and consistently has record sales/revenues, year after year, there's a problem.

__________________

The forest was shrinking, but the Trees kept voting for the Axe, for the Axe was clever and convinced the Trees that because his handle was made of wood, he was one of them.

|

|

|

Appreciate

0

|

| 02-15-2024, 02:59 PM | #8166 | |

|

Major General

5554

Rep 5,372

Posts |

Quote:

__________________

The forest was shrinking, but the Trees kept voting for the Axe, for the Axe was clever and convinced the Trees that because his handle was made of wood, he was one of them.

|

|

|

Appreciate

0

|

| 02-15-2024, 03:18 PM | #8167 | |

|

Private First Class

314

Rep 145

Posts |

Quote:

On the other side of our business (IT services), new business development has been very slow since October. Existing client sales are fine, but new clients are becoming very hard to dislodge. |

|

|

Appreciate

0

|

| 02-15-2024, 04:47 PM | #8168 | |

|

Captain

3503

Rep 1,004

Posts |

Quote:

|

|

|

Appreciate

0

|

| 02-16-2024, 07:55 AM | #8169 |

|

Major General

10161

Rep 8,626

Posts |

this is for our resident BS'er chassis who claimed otherwise just yesterday -

https://www.cnbc.com/2024/02/16/janu...-expected.html

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

Appreciate

0

|

| 02-16-2024, 10:08 AM | #8170 |

|

Colonel

6553

Rep 2,310

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

MSM not credible. And you didn’t answer the question. Are you monologuing?

Some good posts on this page from people who use their brains and apply them to data. |

|

Appreciate

0

|

| 02-16-2024, 10:42 AM | #8171 | |

|

Major General

5554

Rep 5,372

Posts |

Quote:

Those that believe low interests rates are coming back anytime soon are smoking crack. Back in the early 2000s, most of use had 6-7% 30 yr fixed home interest rates and we thought that was decent. We all lived through it too. Same goes for the subsequent housing crash. It was real tough for some, but we all lived. The crash this time will be commercial real estate. It's coming.

__________________

The forest was shrinking, but the Trees kept voting for the Axe, for the Axe was clever and convinced the Trees that because his handle was made of wood, he was one of them.

|

|

| 02-17-2024, 01:05 PM | #8172 | |

|

Private First Class

314

Rep 145

Posts |

Quote:

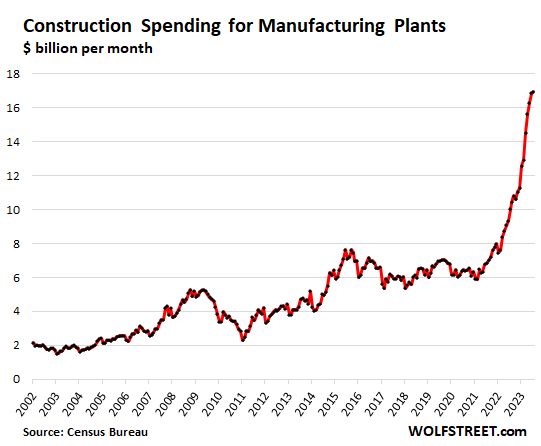

A lot of the deflation over the last 40 years came from moving manufacturing to China. We've wrung just about every dollar out of that trade, and now with reshoring of manufacturing we'll likely see prices increase instead of decrease. |

|

|

Appreciate

0

|

| 02-17-2024, 02:54 PM | #8173 | |

|

Colonel

6553

Rep 2,310

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

What is the entire net effect of reshoring and boomer retirements? Please paint the entire picture for us rather than just a corner of it. |

|

| 02-18-2024, 07:44 AM | #8174 | |

|

Private First Class

314

Rep 145

Posts |

Quote:

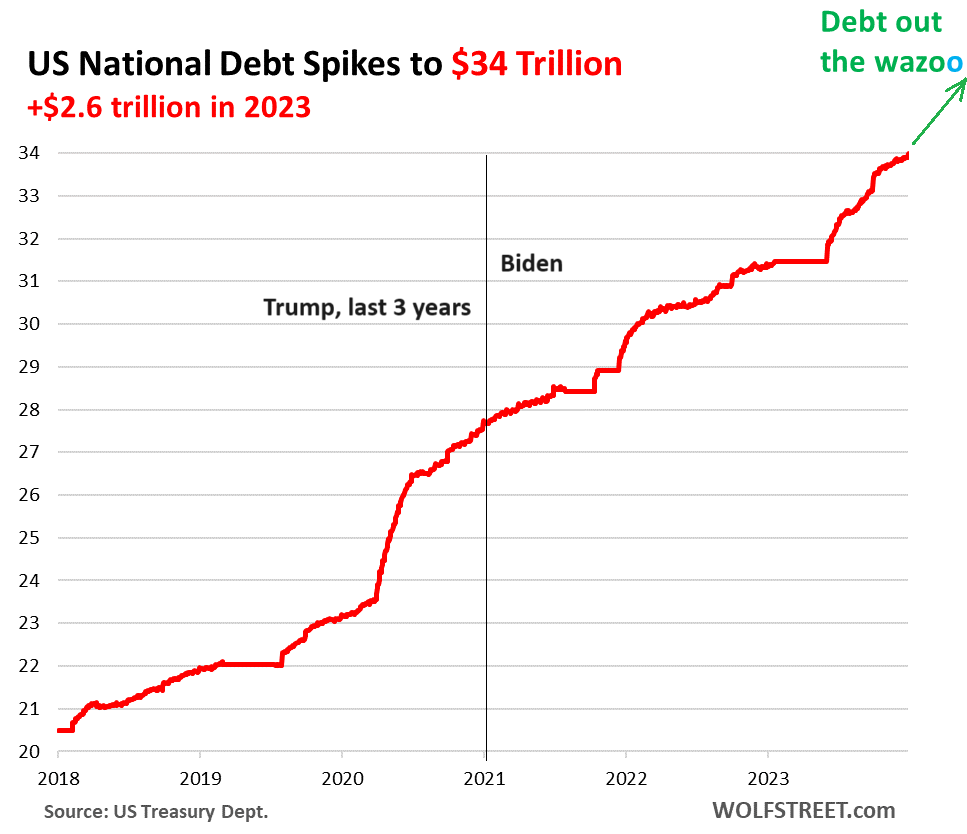

The cost of labor, shipping, and doing business in general in Asia has increased in recent years. Same goes for labor costs in Mexico. As a result, the benefits of this offshoring have been decreasing for some time, but they're still there. However, since COVID, industry realized that long supply chain/just in time operations have some major achilles' heels and started to re-shore that manufacturing to the US and Mexico. Intel's big investment in Ohio being a great example of this.  It's inflationary because it will be more expensive to manufacture in the US than Asia, it's creating demand for construction jobs, manufacturing jobs, mainland transportation jobs, land, materials, etc. Boomers retiring are taking a huge chunk of mature workers out of the economy. The current 22-40 year bracket of workers have very different views on work and skew heavily toward white collar and not blue collar jobs. Hence shortages of skilled laborers, especially in the woodworking, plumbing, electric trades. Want to know why your home renovation is a solid 50% more expensive now than in 2018-2019? Because they can charge it, especially if they're quality, reliable, and get the job done in a timely manner. Deficit spending: we haven't even talked about the big enchilada which is government spending:  On top of all this, there are some estimates of between $3.5 - $5 trillion in private equity and family office money sitting on the sidelines, available to be deployed. There's still a lot of money floating around out there, and a lot of factors that are going to conspire to keep rates higher for longer. |

|

|

Appreciate

0

|

| 02-18-2024, 09:23 AM | #8175 |

|

Private First Class

314

Rep 145

Posts |

Oh, I'll add another one into the mix: insurance rates are skyrocketing. Anyone here have a recent home and/or auto policy renewal? You're most likely looking at a minimum 20% increase overall, upwards of 50% if you live in an area like California or Florida.

|

|

Appreciate

2

floridaorange10161.50 Car-Addicted7049.00 |

| 02-19-2024, 06:24 AM | #8176 | |

|

Private First Class

220

Rep 131

Posts |

Quote:

This is the major factor that may move the market up. The market is overbought on the expectation the Fed will lower rate soon and fast. |

|

|

Appreciate

0

|

| 02-19-2024, 11:26 AM | #8177 |

|

Captain

1691

Rep 685

Posts |

My home went up 20% but my autos (commercial and personal) and business policies stayed the same.

|

|

Appreciate

0

|

| 02-19-2024, 11:28 AM | #8178 |

|

Captain

1691

Rep 685

Posts |

My NVIDIA stock is up 330% since I bought it less than a year ago, trying to decide if I should sell it off? My Bitcoin is up over 100% as well plus tons of other stocks are up over 100% in the last year.

|

|

Appreciate

0

|

| 02-19-2024, 01:29 PM | #8179 | |

|

Colonel

6553

Rep 2,310

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

Retirements - doesn’t this create opportunities for younger workers therefore reduce the risk of higher unemployment? Are you a boomer? Reshoring - same as above, doesn’t this bolster employment demand and increase wages so people can pay for living expenses? Yes it has a relationship to inflation but wouldn’t you rather have high labor demand vs low labor demand? Do you agree the Federal debt is a red herring and is meaningless? Money on the sidelines is another red herring, do you agree? |

|

|

Appreciate

0

|

| 02-20-2024, 08:00 AM | #8180 |

|

Major General

10161

Rep 8,626

Posts |

I don't see how debt can be a red herring... debt needs to be paid for... if it doesn't then it's ultimately a made up number and no one's personal debt should matter either. We should really be striving to reduce that debt so our currency doesn't become worthless when they end up printing more money and lowering rates again. Politically, reducing spending won't work out well for anyone so I don't see that happening...

Either way - irrelevant of WHO wins the next election, the debt will continue to go up and up. Here is my prediction - Biden winds - the endless spending spree continues and after the election money printing restarts and the admin pushes to lower rates again as the economy slows Trump - spending spree continues but perhaps not to the same degree... instead we get some corporate / wealthy tax cuts again which run up the deficit, he pressures the fed to drop rates and money printing restarts again Point being, either way... no one is fixing this issue. As far outsourcing... this has indeed allowed for cheaper manufacturing of goods... but AT what cost to the labor market / business internally? We are at a point where we are producing so little and running on a fully service based economy... that's fine until it isn't because you realize your entire economy revolves around passing fake money around without anything of true value being created.

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

Appreciate

0

|

| 02-20-2024, 08:42 AM | #8181 | |

|

Private First Class

314

Rep 145

Posts |

Retirement creates opportunity, but younger workers tend to be less efficient than seasoned staff. More importantly, there's a critical shortage of skilled labor that is getting worse with boomer retirements taking that knowledge with them, and fewer young people entering the space.

Not a boomer. Reshoring does bolster employment and material demand...which is inflationary. Debt always reaches a tipping point. To attract buyers of debt as the amount of debt increases, yields will necessarily need to rise. Which is...inflationary. Money on the sidelines shows you how much additional capital is sloshing around out there looking to be put to use. Which is...inflationary. Quote:

|

|

|

Appreciate

0

|

| 02-20-2024, 10:47 AM | #8182 | |

|

Colonel

6553

Rep 2,310

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

Reshoring is inherently good. Do I understand correctly that you hold a different view? Money on the sidelines and government debt and deficit are red herrings. Rather, money on the sidelines is demonstration that the harvest has been fruitful. Grain is gathered in barns waiting to be deployed to tables in the form of bread, or to be replanted for the next bountiful harvest. |

|

|

Appreciate

0

|

| 02-20-2024, 10:58 AM | #8183 |

|

Lieutenant Colonel

7049

Rep 1,910

Posts

Drives: 2020 BMW M4 CS

Join Date: Jun 2023

Location: Central PA

|

Interesting that inflation is almost always considered in the value of everything but so few people view the market in a "adjusted for inflation" view. The period of

2021 to 2024 price level has risen by about 18 percent. The real (inflation-adjusted) rate of return in the S&P 500 after three years is thus only 8%. Feeling better now? |

|

Appreciate

0

|

| 02-20-2024, 11:54 AM | #8184 | |

|

Private First Class

314

Rep 145

Posts |

Quote:

|

|

|

Appreciate

0

|

Post Reply |

| Bookmarks |

«

Previous Thread

|

Next Thread

»

|

|

All times are GMT -5. The time now is 08:21 AM.